How to Introduce Financial Literacy Through Real-Life Scenarios

Hello, young scholars! Today we are going to discuss an extremely important topic: managing money. You'll probably be thinking why you need to know how to manage money. Well, financial literacy is enabling you to effectively use and manage your money most rationally and set yourself up for a good future.

What is Financial Education?

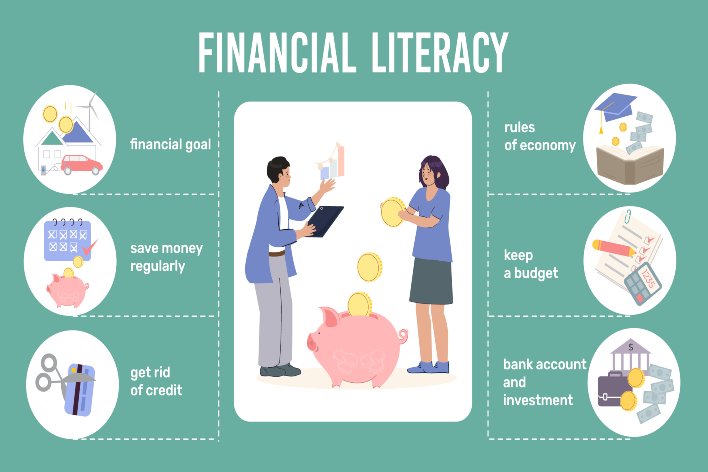

Now, let's first define what financial knowledge is. Financial knowledge refers to the ability or capability to understand savings, spending, investing, and budgeting concepts. It's not just money, but rather how it is spent.

Importance of Financial Literacy

Well, if you realize how much a financial literacy skill can transform your life, then congratulations—you've already learned. Using good money management will help steer you away from the overspending pitfalls and debt. You'll also be more savvy at saving up for that new toy, video game, or even college someday!

Financial Literacy Introduction Using Real-Life Examples

Indeed, the very best applications come alive in real life. Here's one way in which you can illustrate financial literacy using everyday scenarios that might come your way:

The Allowance Scenario

Imagine receiving an allowance each week. It is a fantastic example of money management! Here's how to approach it:

Set Goals: There will be something to save for. Perhaps a new bike or that expensive video game. This will help develop an idea of how to control money.

Create Budget: Write down what one has, what they intend to spend it on, and how much they want to save. It can develop very important money management habits.

Money Management Tips for Kids

Some of the very practical money management tips that may help get you started in saving your money include the following:

Save a Percentage: Try to save at least 10% of your allowance. It will help you set the pace for saving.

Track Your Spending: Record everything you buy. This way you can see exactly where your money is going and adjust accordingly.

Use Images: Make a savings chart that would track your progress. That might motivate you as you see the money you save.

The Grocery Shopping

Getting out to shop for groceries is a great opportunity to implement money control. This is how you could do it best:

Preparation of a Shopping List: In preparation for going to a shop, you should first of all determine what you need or probably purchase. This would prevent you from losing track of your budget and buying things you do not need.

Budgetary Determination: The other key step of intelligent management of money is the decision of how much you are going to spend before leaving for a shop.

Compare Prices: Sales and Compare Prices from Supermarkets. The book also teaches one how to manage money and smart shopping.

Financial Education for Students

Financial education for students can easily become a great catalyst for bringing the concept into one's life. Basic education encompasses so much of the traditional fields, and hence learning financial management skills is no less important.

Workshops and Classes: The school can train the students on budgeting, saving, and investing. This can further extend the practical exposure to the concept of money management.

Real-Life Projects: In this activity, the management of a mock budget can be assigned to the students. In turn, it can make the student learn further how to manage financial knowledge.

The Birthday Party Planning

For this activity, planning a birthday party is an exciting way in which a student can interact with money management. Here is how.

Determine the Budget: How much is it that you can afford to spend on hosting the party? What are some of the expenses you include in it? Some of these are food and drinks, decorations, as well as entertainment for example.

Identify Between Needs and Wants: You know that what you need is the cake and drinks, while it's nice to have balloons or party favors.

Recording the Expense: Record how much money you have spent on the party. This will teach you how to handle finances well.

Money Management for Future Success

Indeed, most people who master money management skills at a very tender age prepare for the realities of financial responsibilities that await them later on in the future. It matters because:

Avoid Debt: By learning the appropriate money management, one can avoid debt; therefore, a dream can easily be achieved.

Invest in Your Future: Such knowledge proffers the basic concept of savings and investment whereby one mainly focuses on college or saving for a first car.

Build Confidence: The more you practice, the more confident you'll become in managing your finances.

The Savings Challenge

You can also have fun building financial literacy by doing a savings challenge. Here's how:

Set a Savings Goal: Select a specific item or experience you want to save for.

Create a Savings Plan: Determine how much you need to save each week to reach your goal.

Mark Milestones: Celebrate your mini-goal attainment.

Why Students Need Financial Literacy Knowledge

It is a fact that any student needs to understand financial literacy's importance. The bottom line is as follows:

A Future Foundation: A person who learns about finances very early will have a strong foundation for better financial success in the future.

Empowerment: Financial literacy helps you make informed choices, hence a better quality of life.

Accountability: Managing your money responsibly builds independence as you approach adulthood.

Real-Life Applications of Money Management

For the sake of clarity, let's discuss some real-life applications where this skill is put to use:

Teen Job Savings: If you have a part-time job, consider saving part of it. Save this money while still being mindful that you just worked for it. This will make you understand the effort of working hard and the need to save for future goals such as college or a car.

Family Budget: Discuss with your parents how they budget the money of the family. Balancing the needs and wants of a household budget can give you insight into how to budget.

Investment Simulation: You can "invest" a virtual amount in various ventures. Then, you can enjoy learning about risk and reward in a fun environment.

Advocating for Financial Literacy at Home

Parents are one of the primary models of financial literacy for their children. Here is how they can help support that:

Money Matters: Start encouraging money matters to be talked about at home. This becomes a good source of safety to ask questions and learn.

Involve Kids in Shopping: Take the child out shopping with you and discuss budgeting, comparing prices, and making those decisions.

Open a Savings Account: Open a savings account for the child. A tangible move is sure to reinforce saving as a practice.

Conclusion

Introduction to financial literacy: With the knowledge of financial literacy, you will learn how to manage money properly, which will help you throughout your lifetime. You learn how to manage money effectively to make the right decisions, avoid debt, and save for your dreams. The journey of finding your way towards financial literacy is exciting, and it all begins with understanding the basics!

Now go out there and apply these tips to your everyday living and watch your knowledge of finances grow!

FAQs

How to make finance literacy learning engaging?

Gaming and apps have proven to be the best tools along with the hands-on setup for its delivery. Making learning about money engaging to the students is the way to go.

How to apply financial literacy in daily life?

Prepare budgets, track expenditures, save for goals, and compare prices of other products, making proper daily financial decisions.

How can financial knowledge be related to real life?

Financial literacy provides awareness to make judicious decisions regarding saving, investing, and spending leading to the achievement of better financial stability.

How to involve financial literacy in a student's life?

Teaching should begin with basic savings and expenses. Relatable examples to explain the concepts should be made. Using hands-on activities makes learning interesting for students.

Discover more exciting ways to make learning fun—explore our site for engaging resources and activities today!

Other Related Sections

NCERT Solutions | Sample Papers | CBSE SYLLABUS| Calculators | Converters | Stories For Kids | Poems for kids | Practice Worksheets | Formulas IBlogs

Also Read

Using Educational Apps to Support STEM Learning | Transform learning, explore STEM apps!

The Role of Creative Writing in Developing Innovative Thinking | Ignite creativity, inspire innovative minds!

Admissions Open for

CBSE Schools In Popular Cities

- CBSE Schools in Bangalore

- CBSE Schools in Mumbai

- CBSE Schools in Pune

- CBSE Schools in Hyderabad

- CBSE Schools in Chennai

- CBSE Schools in Gurgaon

- CBSE Schools in Kolkata

- CBSE Schools in Indore

- CBSE Schools in Sonipat

- CBSE Schools in Delhi

- CBSE Schools in Rohtak

- CBSE Schools in Bhopal

- CBSE Schools in Aurangabad

- CBSE Schools in Jabalpur

- CBSE Schools in Jaipur

- CBSE Schools in Jodhpur

- CBSE Schools in Nagpur

- CBSE Schools in Ahmednagar

- CBSE School In Tumkur