Planning The Best Investment Plans For Your Child’s Education

By Divya Chopra |

Date 05-09-2023

Table of Contents

Admissions Open for

Introduction

As you start planning to welcome your child in the world, you begin dreaming about their future. As parents, you want to give them the best of everything there is to offer. Education is the best present you can give your child. Investing in your child’s education reaps unparalleled returns which last a lifetime! If you are a newbie parent who hasn’t started planning your child’s education, don’t worry! ALL IS WELL! The time to look for investment plans for child’s education is NOW!

Tips to Consider Before Investing

Financial planning for child’s future is no joke. It requires good research and financial consultation to find an investment plan that is reliable. We have a few tips that you would want to consider before choosing the best investment for child education:

- Advance planning – You should commence searching for investment plans for child’s education well in advance. Education investments need to be done following thorough research, financial guidance and comparing plans. Impromptu investments may lead to poor returns which may not be enough to support your child’s future educational needs.

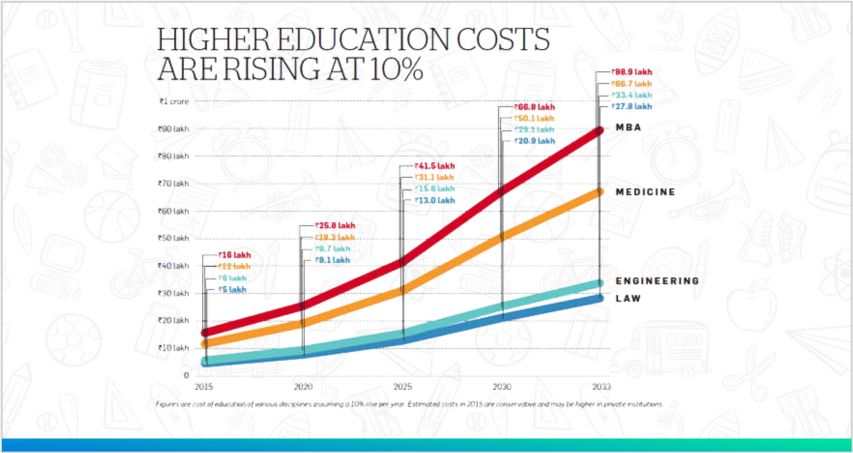

- The amount of investment – This is one of the most crucial investment factors while planning your child’s education. The education fee structure of today will double in the next ten years. You can refer to the current education fees as the basis of calculation and determine your investment amount accordingly, keeping in mind about the education inflation that will occur in future.

- Term of maturity – Selection of your child’s education investment should be such that it gets you the returns at least a year before its need arises. This will help you stay prepared ahead of time avoiding any last-minute arrangements.

- Type of investment – As you begin searching for investment plans for child’s education, you will come across various investment options. However, your choice of investment should ideally depend on one that provides maximum returns with least amount of risk. The return on investment (ROI) should be high as you would be investing for a long period of time.

Education inflation is a real thing. Want to hear something that will blow your mind? In a survey conducted by the National Sample Survey Office (NSSO), 2014 it was found that within a span of 2008-2014, the average education expenditure (for private schools) in India increased by 175%!

Sadly, controlling inflation is not in our hands. However, you can follow these three simple steps to sail through the education inflation smoothly:

Three Simple Steps to Sail Through the Education Inflation

- Plan

- Invest

- Relax

Now that you know about all the prerequisites for planning your child’s education, it’s time to look for the best investment plans for child’s education that are most suitable for your needs.

4 Common Investment Avenues Selected by Most Parents

- ULIPs – One of the best investment for child education is the Unit Linked Investment Plan. It is an integrated plan that provides parents with investment opportunity and insurance too! This is why it is the most opted investment plan for child’s education as it gives your little one the savings and protection he/she needs for a bright future!

- Mutual Funds – It has gained widespread popularity among other investment options over the last few years. Saving your money on a monthly-SIP basis can be a great way to invest for your child’s education. However, the charges to manage your funds are higher when compared to ULIPs.

- PPF – Public Provident Fund is a promising investment option if you are looking for long-term investments. You can also invest in instalments if you decide to choose this investment avenue. It is a risk-free investment which can be opened under the name of your child, provided that you operate their account.

- Education Loans – This is also a common investment plan opted by parents to support their children to pursue higher studies. It often comes as a last-resort option as the minimum eligibility criteria to avail this loan is 18 years. However, it is an investment that provides reliable returns.

Over the years, the need to educate children to build an educated nation has gained importance in the Indian context. Parents of the 21st century like you, are among those who realise the importance of saving and investing in your little one’s education. It is through financial planning for child’s future that we, as a nation, will collectively achieve the goal of an educated and skilled India.

Report by WEF 2017

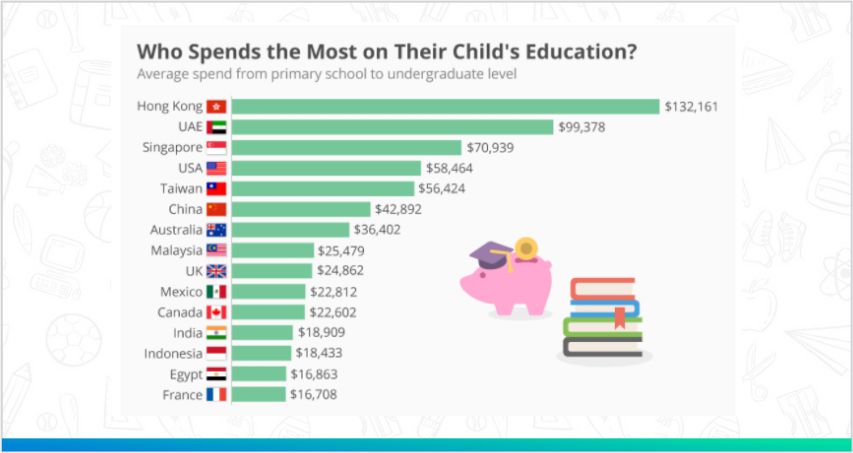

In a report by the World Economic Forum in 2017, it was found that India was among the countries that spend the least on children’s education, with an average of less than 20,000 dollars. Hong Kong was the top country where parents spent more than 130,000 dollars on child’s education.

Conclusion

These words by Nelson Mandela are to live by – “Education is the most powerful weapon which you can use to change the world.” You, as a parent, have the opportunity to give this powerful tool of education to your beloved child by planning your child’s education. Choose your investment plans for child’s education wisely and let its returns ripple through a lifetime! Happy investing.

CBSE Schools In Popular Cities

- CBSE Schools in Bangalore

- CBSE Schools in Mumbai

- CBSE Schools in Pune

- CBSE Schools in Hyderabad

- CBSE Schools in Chennai

- CBSE Schools in Gurgaon

- CBSE Schools in Kolkata

- CBSE Schools in Indore

- CBSE Schools in Sonipat

- CBSE Schools in Delhi

- CBSE Schools in Rohtak

- CBSE Schools in Bhopal

- CBSE Schools in Aurangabad

- CBSE Schools in Jabalpur

- CBSE Schools in Jaipur

- CBSE Schools in Jodhpur

- CBSE Schools in Nagpur

- CBSE Schools in Ahmednagar

- CBSE School In Tumkur

Call Us to know more about Orchids

Swipe Up